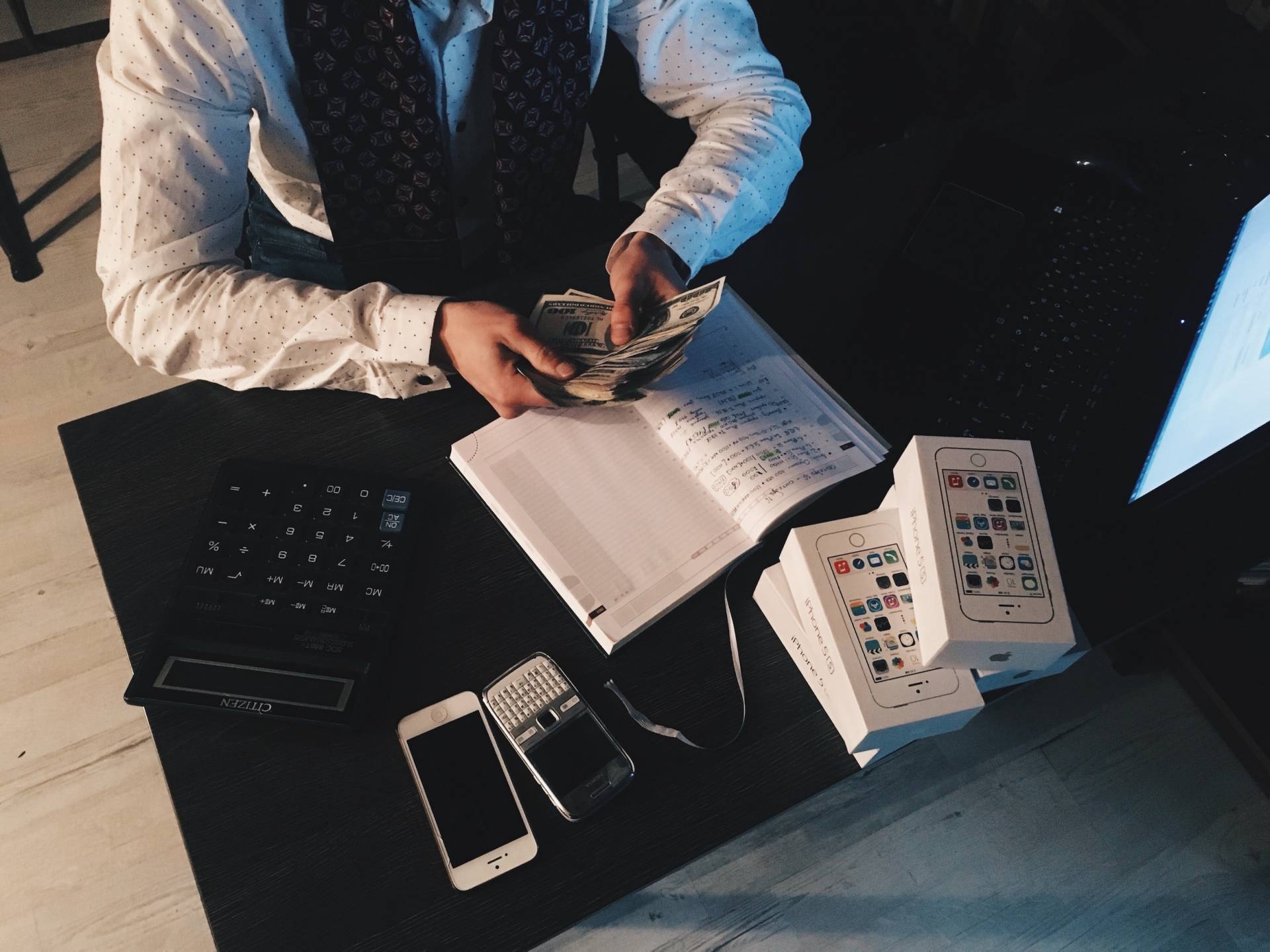

In recent years, money management apps have grown in popularity. People download money management apps in order to track spending, budget money, and plan for the future. You can download a money management app to your cell phone, your tablet, or your laptop. Using these apps on the go is easy. You do not have

to call your bank or talk to a finance specialist to get a better understanding of your finances. With the right money management app, you can quickly check your budget before deciding whether to make a purchase or not. Money management apps can help you to hold yourself more accountable for purchases and spending habits.

You Can Learn More About Your Finances and Credit With Money Management Apps

You may want to know the answers to frequently asked questions, like how can credit cards be more secure than cash or what’s the best way to pay off debt fast. Money management apps are designed to educate you along the way. You will learn special tips and tricks to raise your credit score and build positive financial history. It is never too late to start learning about your finances and credit. Take advantage of all the resources and tools at your disposal.

You Can Track Your Spending Habits

After downloading a money management app, you might decide to start tracking spending habits. Small purchases add up. You might be surprised by the monthly or yearly impact of habits like vaping or drinking. Money and personal finance apps often use graphs and other tools to help you visualize your current spending habits. From there, you can assess what you are doing well and what you might like to change. Once you set a goal to spend more responsibly, you can use money apps to keep track of your progress towards that goal. Watching your spending habits change for the better over time can be highly rewarding.

You Can Budget

A personal finance app can also help you to budget your money better. First, you can keep track of direct deposits and other payments that you have coming into your bank account. You can budget different amounts of money for savings accounts, rent, loan repayments, utility bills, car related expenses, grocery shopping, childcare, medical expenses, leisure, and other life expenses. Doing all of the math required to make a tight budget work can be difficult. Money management apps can help to take some of the guesswork out of this process. If you are spending too much money in one area, you might try to change your habits so that they are more cost effective in the future. For example, you may have a tight food and grocery budget. Instead of eating fast food every day, use store brand grocery items and coupons to save money.

You Can Save Up Money and Plan for the Future

Tracking and planning your spending habits can help you in a variety of different ways. Many people find that they are able to save more money when they track and plan their finances using a money management app. Saving money is important, even if you do not make a lot of money at work. You need to save money in case of emergencies, medical bills, moving expenses, job loss, and other potential situations that can arise in life. In general, it is smart to put at least 10 percent of your income into a savings account that you do not touch.

There May Even Be Bonuses for Sign Up or Referrals

Some money management apps even offer cool bonuses for users when they sign up or refer new users to their platforms. You might be able to take advantage of paid app features for free or for a discounted rate. You may even receive cash or prizes. Some money management apps host fun contests and giveaways that their users can take part in.

If you want more control over your money – especially if you’re working on a tight budget, using money management apps should be able to help you. Between tracking your funds, scheduling payments and setting money goals for the future, these clever smartphone money apps can really save you in many ways. Once you take the time to select the right money personal finance apps for you and your financial needs, you will be off and running towards a happier, healthier bank account.